philadelphia wage tax return

Anyone can also download a copy of the form. The Department of Revenue has provided important reminders regarding the new electronic processes for 2022.

Philly Workers Who Stayed Home May Be Due A Wage Tax Refund Newtown Township Bucks County Pennsylvania

Wage and Earnings taxes Starting on July 1 the new resident rate for the Wage and Earnings taxes is 379.

. For non-residents the Wage and Earnings Tax rates will be 34481. 4902-4903 as amended I swear that I have reviewed this return and accompanying statements and schedules and to the best of my knowledge and belief they are true and complete. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

In Line 1 - W-2 name use the drop-down and select the appropriate W-2 to link. TaxSlayer Pro supports the following returns. In Line 3 - Include wages from this compensation in preparation of the annual reconciliation of employee earnings tax select the checkbox.

The City of Philadelphia has several municipal tax returns that an individual taxpayer may need to complete if they lived in andor worked in the city. The Wage and Earnings taxes apply to salaries wages commission and other compensation. Philadelphia Wage Tax Withheld on W-2 - The wage tax withheld is pulled from the Form W-2 s entered in the federal return if the locality begins with PHI.

Business Income Receipts Tax Return BIRT Individuals engaged in any for-profit activity within the city of Philadelphia must file a BIRT return. Download forms and instructions to use when filing City tax returns. Under penalties of perjury as set forth in 18 PA CS.

The City of Philadelphia is decreasing its Wage Tax and Earnings Tax rates for resident and non-resident taxpayers as of July 1 2021. The rates were previously 38398. The Earnings Tax rate for residents is also decreasing from 38712 to 38398.

Nonresident Earnings Tax rates will be reduced to 34481 percent down from the previous rate of 35019 percent and resident Earnings Tax rates will be reduced from the previous rate of 38712 percent to 38398 percent effective July 1. Forms include supplementary schedules worksheets going back to 2009. You can choose to continue filing paper returns for this tax.

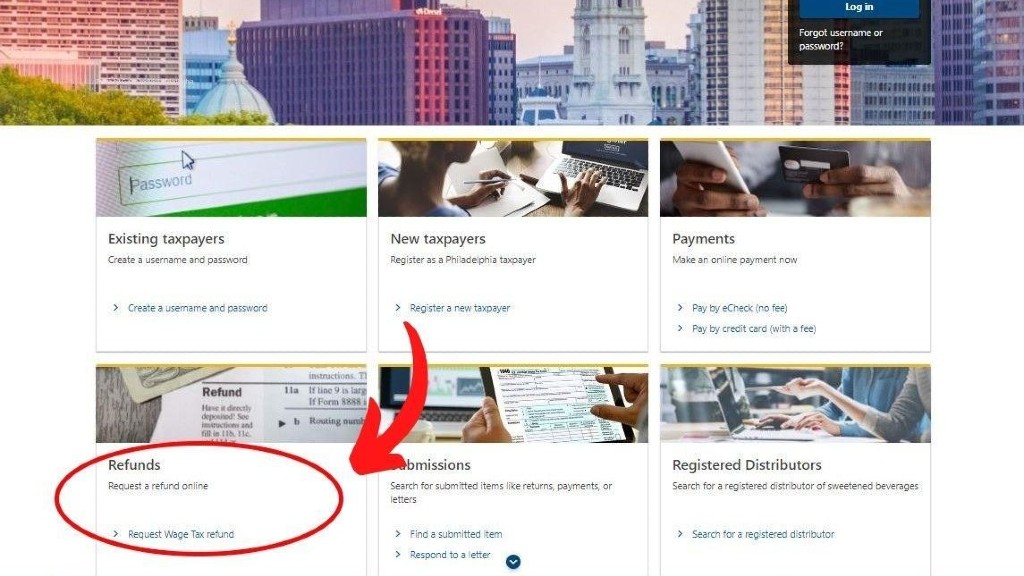

Upload Employer Submitted Wage Tax Refund Request - Employer Submitted Wage Tax Refund Request. They are two sides of the same coin. All Philadelphia residents owe the City Wage Tax regardless of where they work.

Non-residents who work in Philadelphia must also pay the Wage Tax. The Earnings Tax rate for residents is also decreasing from 38712 to 38398. 2 Reply peter-gabriel New Member March 14 2021 1247 PM Thanks ErnieS0.

Go to Philadelphia Earnings Tax. The deadline is weekly monthly semi-monthly or quarterly depending on the amount of Wage Tax you withhold. Ad PA Employee Earnings Tax More Fillable Forms Register and Subscribe Now.

The new rates are as follows. Here are the new rates. Select Section 1 - General Information for Earnings Tax and Wage Tax Petition.

The Business Income Revenues Tax BIRT is now levied at 1415 mills 1415 per 1000 of gross receipts on gross receipts and 620 percent on taxable net income at the present rates. The new Wage Tax rate for residents is 38398. The City Wage Tax is a tax on salaries wages commissions and other compensation.

What is the city Wage Tax in Philadelphia. Ad Access Tax Forms. From now on you can complete online returns and payments for this tax on the Philadelphia Tax Center.

Under penalties of perjury as set forth in 18 PA CS. For help getting started and answers to common questions you can see our online tax center guide. The tax applies to payments that a person receives from an employer in return for work or services.

Click for 1099 Instructions. The new non-resident rates will be a flat 344 for Wage Tax and 344 for Earnings Tax they were previously 34481. The City of Philadelphias Department of Revenue has changed the Philadelphia Wage Tax Return filing requirement to quarterly.

Beginning on July 1 2021 the City of Philadelphia will lower the rates of its Wage Tax and Earnings Tax for both resident and non-resident taxpayers alike. What is BIR tax Philadelphia. 20 rows Semi-monthly and weekly filers must submit their remaining 2021 Wage Tax returns and payments electronically through the Philadelphia Tax Center.

Tobacco and Tobacco-Related Products Tax. The first due date to file the Philadelphia Wage Tax return quarterly is May 2 2022. Do I pay city taxes if I work from home.

Click for W2 Instructions. City of Philadelphia Wage Tax This is a tax on salaries wages and other compensation. The rate on taxable net income in 2019 was 625 percent according to the IRS.

Complete Edit or Print Tax Forms Instantly. You can claim a tax credit pro-rated dollar for dollar for Philadelphia City wage taxes paidwithheld appearing on your W-2 box 19 and 20. To qualify your income must be subject to both the New Jersey income tax and the income or wage tax imposed by another jurisdiction outside of New Jersey for the same year.

Electronically file your W-2 forms. Forms instructions Paper income-based Wage Tax refund petition. Enter the number of Philadelphia Residents for whom wage tax was remitted for the pay period.

4902-4903 as amended I swear that I have reviewed this return and accompanying statements and schedules and to the best of my knowledge and belief they are true and complete. Ad PA Employee Earnings Tax More Fillable Forms Register and Subscribe Now. Electronically file your 1099.

The new rates are as follows. Philadelphia employers are required to give an income-based Wage Tax refund petition form to employees by February 1. In most cases employers provide the refund petition at the same time they provide employee W-2s or comparable forms.

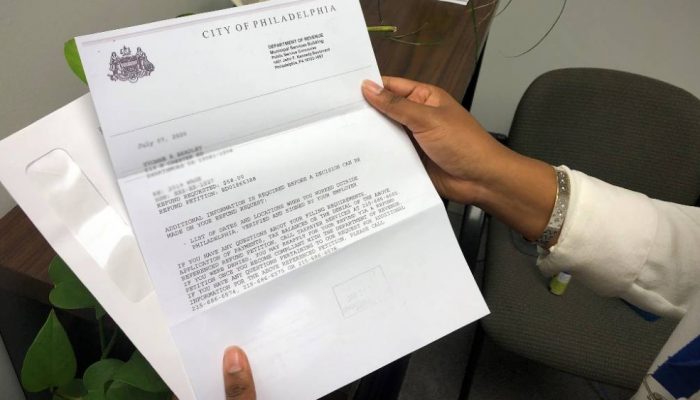

Philadelphia says A petition for refund of erroneously withheld wage tax from an employee must be made by the employer for and on behalf of the employee Refer to instructions on the form. Starting in 2022 all Wage Tax filings must be done in the Philadelphia Tax Center regardless of frequencies. Beginning on July 1 2021 the City of Philadelphia will lower the rates of its Wage Tax and Earnings Tax for both resident and non-resident taxpayers alike.

If the total tax due is less than that withheld by the employer on Forms W-2 the Earnings Tax Return does not need to be filed. Enter the number of Philadelphia Residents for whom wage tax was remitted for the pay period. City residents have to pay 38712 and non-residents who work in the city owe 35019 2020 tax year.

Tax rate 38398 for residents and 34481 for non-residents IMPORTANT UPDATE. The new Wage Tax rate for residents is 38398. In the state of California the new Wage Tax rate is 38398 percent.

In the state of California the new Wage Tax rate is 38398 percent. The nonresident Earnings Tax rates in Philadelphia Pennsylvania will be reduced starting on July 1 2021. Resolve business and incomeWage Tax liens and judgments.

Sales Use.

2022 Pennsylvania Payroll Tax Rates Abacus Payroll

There S A New Tax Refund Available In Philadelphia This Year Philadelphia Legal Assistance

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Philadelphia Wage Tax Refund Program Goes Online To Ease Process

Cook Reminds Employers Business Owners Of Jan 31 Filing Deadline For Wage Statements Independent Contractor Forms 1099 Http Payroll Tablet How To Find Out

How Do I Check The Status Of My Tax Return Of The Last Three Years Marca

Four Philadelphia Taxes Due On April 18 Department Of Revenue City Of Philadelphia

Philadelphia Launches New City Tax Site Brinker Simpson

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia

File Philadelphia Wage Tax Return Quarterly In 2022 Wouch Maloney Cpas Business Advisors

Understanding A Wage Garnishment And How To Stop It Wage Garnishment Wage Payroll Taxes

Request 2021 Wage Tax Refunds Online Department Of Revenue City Of Philadelphia

10 Tax Commandments To Avoid Trouble With The Irs Rendering Walls Wall Murals Ten Commandments

Philly Taxes Employer W 2 Submission Simplified Department Of Revenue City Of Philadelphia

Trump Admin Fumbling Medical Equipment Supply Chain Management Rachel Maddow Looks At Report Chain Management Supply Chain Management Emergency Management

Delayed City Wage Tax Refunds Still Being Paid Nbc10 Philadelphia

Tax Refund 2022 What To Consider Before Filing Taxes So You Can Get More Back 6abc Philadelphia